Semiconductor sales rose 13.3% in June from a year earlier, down from 18% in May, data from the global peak industry body showed. The current slowdown is the longest since the US-China trade war in 2018. World chip sales growth has decelerated for six straight months, yet another sign the global economy is straining under the weight of rising interest rates and mounting geopolitical risks.

The three-month moving average in chip sales has correlated with the global economy’s performance in recent decades. The latest weakness comes as concern about a worldwide recession that has prompted chipmakers like Samsung Electronics Co. to consider rewinding investment plans.

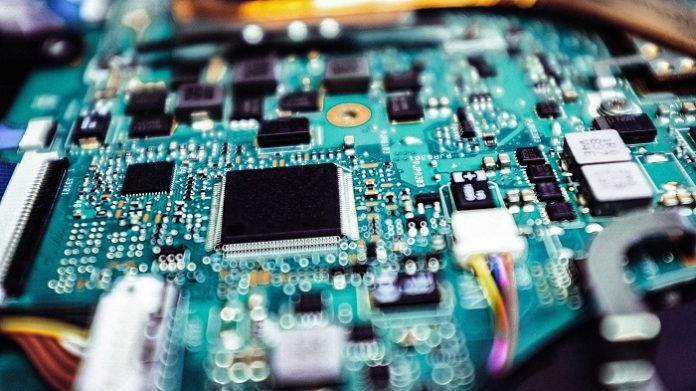

Semiconductors are key components in a world that’s increasingly reliant on digital products and services, particularly during the pandemic when a lot of work and schooling was conducted remotely. Chip sales started to cool as central banks began scrambling to raise interest rates to combat spiraling inflation and Russia’s war on Ukraine and prolonged Covid lockdowns in China prompted a rapid reversal in the international outlook.

Signs of an international downturn are also observed in trade data from South Korea, the world’s biggest producer of memory chips. Growth in chip exports eased to 2.1% in July from 10.7% in June, the fourth straight monthly slowing. In June, semiconductor stockpiles rose by the most in more than six years.

It’s a similar story in Taiwan, which is another key player in electronics supply chains. Latest data indicate manufacturing on the island contracted in June and July, while production and demand slumped, with new export orders registering the biggest fall.

The weakening momentum in these two canaries in the global coal mine is partly due to a slowing economy in China, which continues to impose lockdowns under its Zero-Covid policy. China’s factory activity unexpectedly contracted in July and property sales continue to shrink.

In the US, the gross domestic product has fallen for two straight quarters, though the National Bureau of Economic Research refuses to call it a recession. In Europe, factory activity plunged in June, further darkening the outlook for both the continent and the wider world.

Nonetheless, the International Monetary Fund still sees a global expansion this year, and slowing chip sales don’t automatically indicate a recession is imminent. But they offer a glimpse into the health of an international economy that relies heavily on the tiny components to manufacture everything from cars to smartphones to computers.

The Washington-based Semiconductor Industry Association, the peak world body says it represents 99% of the US chip industry by revenue and almost two-thirds of non-US chip firms. The sales it releases are compiled by World Semiconductor Trade Statistics.